How Quantum AI is Revolutionizing Modern Trading Technologies

In the dynamic world of trading, technology is the ultimate game-changer. Over the past few decades, the evolution of trading tools and algorithms has transformed markets, making them faster and more efficient. At the forefront of this revolution is Quantum AI, a fusion of artificial intelligence and quantum computing. Unlike traditional systems, Quantum AI provides traders with unparalleled insights, enabling them to anticipate market movements, manage risks, and optimize portfolios in ways previously unimaginable.

Introduction to Quantum AI and Trading Technologies

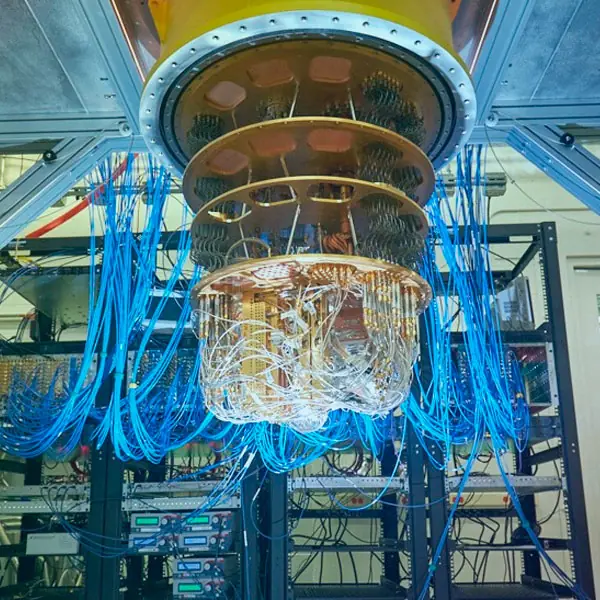

Quantum AI is a cutting-edge field that merges two advanced technologies: quantum computing and artificial intelligence. Quantum computing leverages the principles of quantum mechanics, allowing it to perform computations at an unprecedented scale. AI, on the other hand, excels in analyzing patterns, predicting trends, and automating decisions. When combined, these technologies empower traders with tools capable of solving complex market challenges.

Traditional trading systems often rely on linear data processing, which limits their ability to handle vast amounts of real-time information. Quantum AI, however, uses quantum bits (qubits) that operate in multiple states simultaneously. This unique capability enables traders to process and analyze data faster, uncover hidden opportunities, and reduce latency in decision-making.

The Benefits of Quantum AI in Trading

Accelerated Decision-Making

In trading, timing is critical. Quantum AI’s ability to process data at quantum speeds ensures that traders can act on insights instantly, capitalizing on fleeting opportunities.

Enhanced Predictive Analytics

Quantum AI combines historical data with real-time inputs to forecast market trends more accurately. This predictive edge helps traders anticipate movements in stocks, commodities, and cryptocurrencies.

Advanced Risk Management

Market volatility is a constant challenge for traders. Quantum AI simulates countless scenarios, identifying potential risks and recommending strategies to mitigate losses. For example, it can predict the cascading effects of a geopolitical event on global markets.

Customizable Trading Solutions

Unlike one-size-fits-all approaches, Quantum AI tailors strategies to individual trading goals. Whether you’re a day trader or a portfolio manager, Quantum AI adapts to your unique needs.

Real-World Applications of Quantum AI

High-Frequency Trading

Quantum AI is revolutionizing high-frequency trading (HFT) by minimizing latency and increasing execution accuracy. HFT firms use Quantum AI to process millions of transactions per second, ensuring precision even in volatile markets.

Algorithmic Portfolio Management

Portfolio optimization is a complex task that requires balancing risk and return across multiple assets. Quantum AI simplifies this by analyzing countless combinations in seconds, helping fund managers maximize returns.

Fraud Prevention and Compliance

With its advanced pattern recognition capabilities, Quantum AI can detect anomalies in trading behavior, flagging suspicious activities before they escalate. This ensures compliance with regulatory standards while reducing financial crime.

Market Trend Analysis

Quantum AI’s ability to analyze vast datasets enables it to identify emerging market trends early, providing traders with a strategic advantage in decision-making.

Challenges and Ethical Considerations

Accessibility and Cost

Building and maintaining quantum computing systems is prohibitively expensive, restricting access to large institutions. This raises concerns about market imbalances where smaller players are disadvantaged.

Data Privacy Risks

The immense computational power of quantum systems could potentially compromise encryption protocols, leading to vulnerabilities in sensitive trading data.

Regulatory Gaps

Quantum AI operates at the frontier of technology, outpacing existing regulations. Policymakers must address these gaps to ensure fair and transparent market practices.

Technological Maturity

Despite its potential, Quantum AI is still in the early stages of development. Widespread adoption will require overcoming significant technical and practical hurdles.

The Future of AI in Trading

The integration of Quantum AI into trading is just the beginning. Future advancements could include the creation of autonomous trading systems that self-learn and adapt to market changes. Moreover, as quantum technology becomes more accessible, we can expect its applications to extend beyond trading, influencing areas like supply chain optimization and financial forecasting.

Conclusion and Key Takeaways

Quantum AI is transforming the trading landscape, offering tools that enhance efficiency, accuracy, and adaptability. While challenges remain, the benefits of adopting Quantum AI far outweigh the risks. Traders and institutions that embrace this technology today will be well-positioned to thrive in the competitive markets of tomorrow.

Call to Action: To learn more about Quantum AI, visit the official website or explore in-depth research on IEEE Xplore.